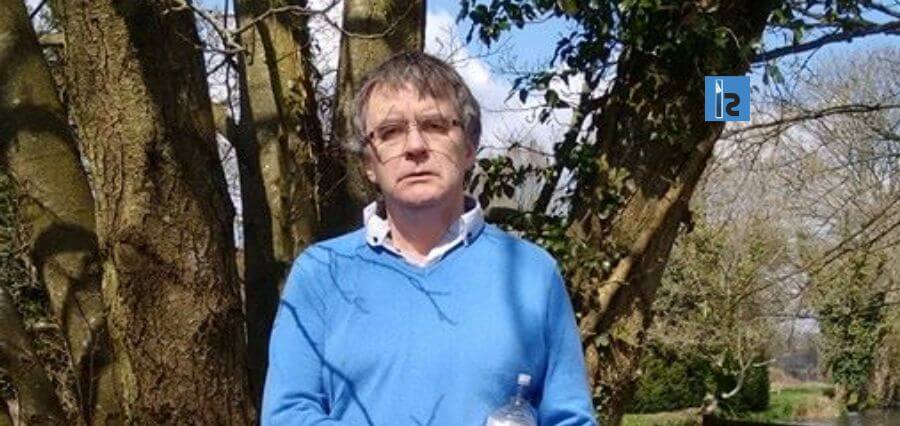

In an interview with Insights Success, Ken Marlin, Founder and Managing Partner of Marlin & Associates Holding LLC, shares valuable insights from the experiences he gained on his entrepreneurial journey. Moreover, he broadly discusses on some of the attributes one should possess in order to become a successful entrepreneur.

Below are the highlights of the interview conducted between Ken and Insights Success:

What past experiences, achievements or lessons have shaped your journey?

I suppose it all has to begin with my time in the Marine Corps. In 1970, when the Vietnam War was still hot, I quit college to enlist in the United States Marine Corps. I spent 10+ years on active duty and that turned out to be a defining time in my life. I was promoted and then sent to officer candidate school where I was commissioned and sent to the 1st Marine Division as a young platoon commander. For the next decade, I had a series of great experiences (and a few not so great ones) in the US and in Asia (where I did two tours) as an Infantry Company commander, a battalion staff officer and as a member of the staff of the Commanding General of the 1stMarine division. As I wrote in my book, that Marine Corps experience taught me a series of valuable lessons on the best ways to lead and motivate men and women and build organizations that will persevere and succeed under complex challenging circumstances that are often chaotic. These are lessons that have served me well leading civilian firms.

How do you diversify your organization’s offerings to appeal to the target audience?

We don’t diversify much. The Marine Corps taught me the benefits of using people with deep domain expertise in clearly defined areas – and that lesson has been reinforced over the years. I’m not a believer in “generalists” in any professional service – be it medicine, law, advertising, or investment banking. We take the opposite tack. We are very focused along two dimensions: the kinds of firms we work with – and what we do for them. We provide trusted strategic and financial advise the top decision makers at tech firms that provide financial software, information, data and analytics and those who would buy or invest in such firms. We help them figure out the best way to achieve their strategic goals with a further focus on efficient effective execution – whether they want to be a buyer, a seller or are looking to raise or invest capital.

Describe some of the vital attributes that every entrepreneur should possess.

I meet a lot of people who say that they want to be – or call themselves – entrepreneurs when they really mean that they would like to reap potential entrepreneurial rewards – but are unwilling to take entrepreneurial risk. Entrepreneurs are risk takers by their nature. They will bet big on themselves – to build a business and achieve their dreams. If they lose, the consequences are often material. But they don’t think a lot about losing. The best ones are also team builders. They know that they can’t build a company alone. If they are smart they learn to listen to the advice and opinions of others – without being slaves to the expectations of others. Ultimately they need to trust their own judgment. One of my favorite quotes is by George Bernard Shaw, who wrote: “The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.” That is the very definition of an entrepreneur.

What were the challenges and roadblocks you faced during the initial phase of your career as an entrepreneur?

Many studies have shown that many businesses that fail because they run out of capital before they get traction. But that begs the question of why that happens. There is a tendency to say they underestimated the time it would take or the capital required. But it is more complex than that. Some of them had good ideas but simply weren’t good enough business people to begin with. They didn’t understand the numbers – didn’t understand timing and level of expected costs in detail nor the timing and realistic amounts of expected future revenue. They didn’t have a well-defined plan and certainly didn’t know how to pivot when that plan wasn’t going as expected. We founded this company in the beginning of 2002. The western world was in a deep recession that had begun with the tech market crash of 2000, followed by the terrorist attacks of 2001.

I had expected the recession would be over by 2002 but it was not. Further I had underestimated how long it would take for us to build a base of clients. But we did a plan – and a modest a cushion of cash. We made no profit in 2002, 2003 or 2004. I lost one of my three people. And then I lost a second. My bank account was nearly dry. But we kept going. Fortunately, in 2005 it all turned around. It’s been a good ride ever since.

Where do you see yourself in the near future and what are your future goals?

The future is more of the same, slow steady building of a franchise that is international and growing. Careful cultivation of our brand and superior service to clients – without taking existential risks.

What is your advice for budding and emerging entrepreneurs?

Go into entrepreneurship clear eyed. It’s risky. Success is not guaranteed and it nearly always takes time. You can’t be in a rush. Be prepared for lean years and spend wisely. You need to have a well thought-out plan – and be willing to modify it as the market dictates. The market will tell you what to do – but only if you listen.

About the Leader

Ken is an investment banker, entrepreneur and international strategist. He is also the author of “The Marine Corps Way to Win on Wall Street: 11 Key Principles from Battlefield to Boardroom”, a book that has garnered strong reviews and has been ranked among the top in governance, finance and leadership.

Over the past 30 years, Ken started and built several tech companies before embarking 17 years ago on a journey to create a different sort of investment bank. One that would meld the investment banking skills he learned on Wall Street with lessons he learned as a tech entrepreneur and then leverage these skills with values and principles Ken learned during the decade that he spent as U.S. Marine Corps infantry officer.

Today, Ken advises U.S. and international financial technology, data and analytics firms on the best ways to buy, sell, grow and thrive. His firm has been the recipient of multiple awards including boutique investment bank of the year, multiple times. Institutional Investor, the international publisher has named Marlin as one of one of the most influential people in the financial technology industry.