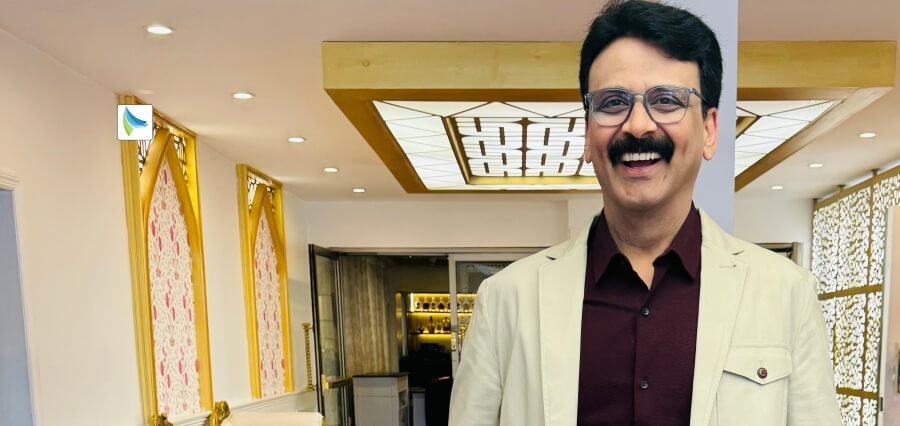

Bolstered by a team of fantastic individuals, each with their unique set of skills and experience, resulting in Lending Valley’s innovation made waves in the FinTech market, allowing it to become the country’s leader funding provider. Led by Çhad Otar, the Founder and CEO, has curated a team of the industry’s best underwriters and business development manager who have industry-specific experience and knowledge, giving them the ability to underwrite and fund deals.

Çhad helps small to midsized business owners obtain capital for expansion, hiring, equipment, marketing, infrastructure, working capital, debt consolidation, and much more. He is honored to be included in the 10 Most Innovative Business Leaders to Follow in 2022 and is excited to share LV’s story.

Finding Success from Adversity

As a first-generation American and a three-time cancer survivor, Çhad always wanted to make something of himself. His main aim was turning adversity into accomplishments, which he fortunately achieved.

Çhad’s career began in 2007 while studying at Columbia, finding himself in the sales division at American Allied Funding and staying there until 2012 until he became a senior funding specialist at Capital Stack.

After a year, Çhad became CEO of Excel Capital Management and increased its revenue by 430% over four years. But it wasn’t until 2019 that he decided it was time to create Lending Valley and build the incredible team it has today.

Lending Valley: Our Missions and Visions

Lending Valley’s goal is to offer every small business owner the best financing at phenomenal rates within the same day and or in 24 hours.

Çhad notes, “Sadly, the finance industry is littered with high-cost financing and unattractive interest percentages. So, our primary mission is to act as a safe haven for small- and medium-sized business owners to obtain the money they need as quickly as possible.”

Çhad thanks his team’s Sharmylla, Clark, Sadman, Danielle, wealth of experience in the industry, as it was crucial to have working relationships to afford the clients the deals and customer service they are searching for. LV’s motto, “providing a lending hand for your business,” couldn’t be more accurate — its white-glove service allowed them to break through into an otherwise crowded market.

Making an Impact Since 2019

There’s no denying that FinTech lenders were borne out of necessity. However, their delivery method of rapid-capital services was an industry game-changer in many ways.

Çhad shares, “Firstly, we understood the gap in the market. Back in 2019, the funding world needed another player. It seemed to stand stagnant — the current lenders found a workable solution and stuck with it. Of course, there’s no problem there; after all, the saying, “if it ain’t broke, don’t fix it,” exists for a reason. But we knew our years of industry knowledge and our diverse team could offer something extra.”

Çhad continues, “Secondly, we took a unique approach to credit. Traditional lenders value borrowers with near-perfect credit scores. But we recognized that many adversities faced by business owners were completely out of their control, making it unjust to judge them solely from the current credit score. Thus, we created a platform that won’t ever penalize our clients for less-than-perfect credit, no collateral, zero credit, or any other financial hardship. Life throws us curveballs as it is; we’re not here to throw more.”

At last, he erased the ever-present convolution in the finance industry. Having been an active participant in the finance space for many years, Çhad completely understood business owners’ apprehension when considering capital acquisition options. Financial jargon and legal terms are abundant with all sorts of loans and lending deals. So, he removed it and focused instead on LV’s customer service.

Lending Valley offers individual attention and care to every one of its clients. Çhad’s team does everything from the paperwork to taking risks to get their customers where they want to be. He adds, “We don’t grow if our glorious clients don’t grow alongside us.”

Value-Driven Toward Success

Lending Valley promotes a familial atmosphere which has proven to be one of its major success factors. Çhad is aware of the financial sector’s impersonal criticism and has broken away from that mold. He ensures a heartwarming work-life balance for all the teams and strives to create a home-from-home atmosphere for our staff and customers alike.

LV treats its customers as family, and the results have been astounding.

Çhad mentions, “Of course, we can’t forget about our 24-hour turnaround time when discussing the factors propelling us to success. Emergencies don’t wait for you, so we don’t make you wait for financing. Many of our customers are fraught with stress when searching for capital. We never add to that by introducing further obstacles; that’s the beauty of FinTech companies like us — fast and reliable capital solutions.”

Lending Valley, Inc. Leveraging The Ever-Changing Technological Landscape

LV has always leaned into brand-new, innovative technology to expand its slice of the market’s pie. But 2022 is set to be one of the most exciting for technological advancements, and the Lending Valley team is more than ready to leverage it all.

It looks to make its underwriting team faster by further automating parts of its process. It plans to make the most out of everything Big Data and advanced machine learning offer.

Çhad expresses, “In that aspect, we’re eons ahead of the traditional lending curve. We aren’t nervous about making significant automation changes to power quicker funding distributions and higher customer satisfaction results. Plus, the more technology progresses, the lower the risk of default — a win-win for everybody involved.”

Additionally, LV is continuing its migration to cloud technology. Before the COVID-19 pandemic, most FinTech companies and other financial services moved to the cloud. However, the chaos caused by coronavirus accelerated everybody’s efforts. Cloud technology makes it easier for them to tailor packages and provide a better service based on technological progress like blockchain and AI.

Essentially, harnessing the improvements is the only way Lending Valley can continue moving forward in the fast-paced micro-lending sector.

The Changes LV Hopes to Make

The world and the financial sector, in particular, have changed a lot since we started in June 2019. From the pandemic accelerating the trajectory of cloud-based solutions to customers looking for rapid capital, the finance market is entirely different from a few years ago. There are a couple of changes the company hopes to inspire in the sector over the following years.

Number one is to help the small business industry get back on track by continuously providing capital to those who need it. Coronavirus has disrupted the industry, causing many never to reopen their doors.

LV wants to be a part of that change and offer the money they need to come out of this stronger. Çhad is proud to be in a position where our bespoke solutions and technology have allowed many small- and medium-sized businesses to continue operating.

Additionally, Çhad would like to encourage more entrepreneurs to break into the finance world, hoping to inspire others who faced challenges at young ages to find success in an otherwise impersonal industry. Çhad states that LV’s familial atmosphere has driven it to the dizzying heights of success, and there’s no better change than helping others obtain that feeling.

Finance Industry Changes: The Predictions

In Çhad’s opinion, the next big change in the finance industry is the application of artificial intelligence (AI), robotic process automation (RPA), and machine learning (ML). AI and ML in the finance world have continued to grow over the years. They’re always improving their algorithms, data analysis process, and pattern recognition to ensure better interpretation of financial information.

As for RPA, the possibilities are endless! The industry is sure to experience increased automation and gain more time to tap into the strategies behind their processes. It’s undoubtedly an enjoyable time to be part of the industry.

The Future Is Lending Valley

Lending Valley’s goals are to keep growing and continue sticking to our motto, “providing a lending hand for your business.” The constant industry improvements allow Lending Valley to be on the top, offering white-glove service to current and future clients.

LV is constantly on the lookout for ways to improve its services. Çhad notes, “Complacency isn’t in our vocabulary. Our team is always striving for the next level to maintain our fantastic track record of catering to merchants who would otherwise be left without working capital. Lending Valley is certainly here for the long haul, and we’re excited to continue helping small businesses in need.”

Breaking Into the Finance Industry: The Advice

The finance sector can be a daunting market to venture into. So, Çhad’s primary piece of advice is to embrace fear and also a leader is as only as good as the people around him. He says, “You’re bound to be scared starting on your own, but fear is a motivator like no other. Using it to your advantage might be the best decision you ever make. As long as you have the knowledge to back up your endeavors, you’re bound to make it with a lot of hard work and perseverance.”

Çhad also suggests finding a mentor as you feel less lonely, but they’ll teach you valuable lessons they’ve undoubtedly had to learn the hard way.

Thank You, For Everything

Expressing his gratitude for his success, Çhad says, “I’d like to take a moment to thank my mother, brother, and everyone who doubted me.”

“To my mom, who taught me more about strength and sacrifice than I could’ve imagined, thank you. To my brother, who gave me the encouragement and support I needed to venture into the financial world, thank you. And to everybody who doubted me, you lit the fire inside me that said, “keep going,” so thank you. Great things are on their way!” Çhad concludes.