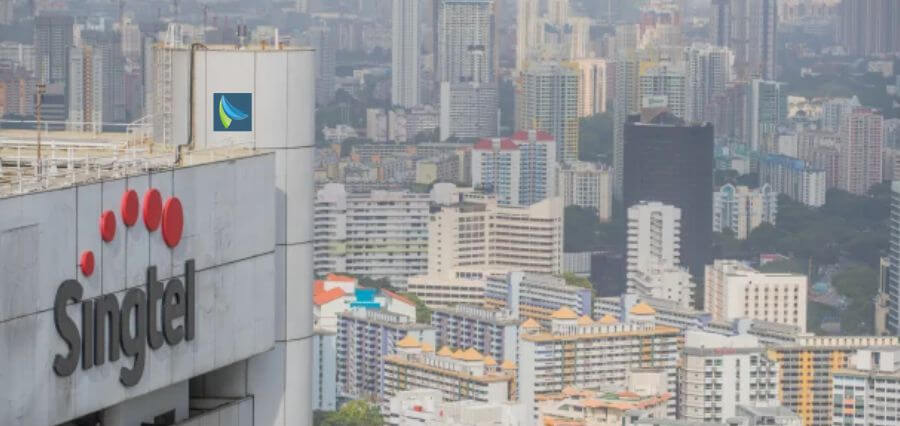

Parent company Singtel was obliged to write off billions of dollars in Optus due to the telecoms group’s problems and the declining Australian economy. In an effort to raise money, Optus signed a $1.6 billion deal with rival TPG Telecom. The $S3.1 billion ($3.5 billion) Singtel write-down was first made public in Singapore early on Monday. It was primarily associated with Optus, which is having trouble with declining revenues in its enterprise division. Gladys Berejiklian, the former premier of New South Wales, oversees Optus, which offers services to government and commercial clients. However, a prompt arrangement with TPG to share regional telecommunications networks has mitigated the financial impact of the write-downs, which would lower Singtel’s yearly earnings.

Investors were informed by Singel that the writedowns were necessary because, at the end of March, Optus’s “recovery value” was less than its carrying value. After enduring a cyberattack and a nationwide network failure during the previous 18 months, Optus is still working to rebuild its consumer trust. In addition, the company is also searching for a new CEO after Kelly Bayer Rosmarin left.

Singtel, however, insisted that the provisions would not affect its dividend payments and that the financial hardship had been mitigated by the new agreement with TPG. In the second half of the fiscal year that ends in March 2024, Optus’ enterprise assets will be impaired by $540 million, and its goodwill will be written down for about $S2 billion.

The Australian Financial Review was informed by Michael Venter, the acting CEO of Optus, that the majority of the write-downs were associated with a “deteriorating outlook” in the enterprise market. Zoom and other internet-based services are taking the place of businesses’ traditional phone call services.

According to Mr. Venter, several segments of the enterprise market—particularly fixed—have recently shown a significant decline in profit as consumers shift away from those kinds of products and toward more modern options. Future profitability is diminished. In an effort to address declining earnings, Telstra is also reorganizing its enterprise division.

The agreement will increase the geographic reach of TPG’s mobile services for Lebara and Vodafone customers. TPG CEO Inaki Berroeta stated, “It will allow us to expand our market and be competitive in regional Australia, which is super important to us.”

A previous $1.8 billion deal proposal by Telstra and TPG to share networks and spectrum—the radio frequencies allotted to mobile service providers—was rejected by competition authorities last year. The reason given by regulators was that they believed the transaction would solidify Telstra’s dominance of the telecommunications industry.

Although TPG had originally favored a partnership with Telstra, Mr. Berroeta stated that since late 2023, the company has been in earnest talks with Optus over a different sharing agreement.

To establish a “multi-operator core network,” TPG will pay $1.59 billion in service fees to Optus over an 11-year period. With the money, Optus will accelerate its investment in 5G networks, completing them two years ahead of schedule. In essence, this trade pays for it, Mr. Venter said.

TPG claims that paying Optus fees is less expensive than developing and running its own network throughout regional Australia, and that the larger network will enable them to draw in more mobile phone users.

For More Details: https://insightssuccess.com