Envision a future beyond what is currently possible. A few leaders have a unique talent for inspiring and motivating others to work towards a common goal while developing innovative strategies to achieve success.

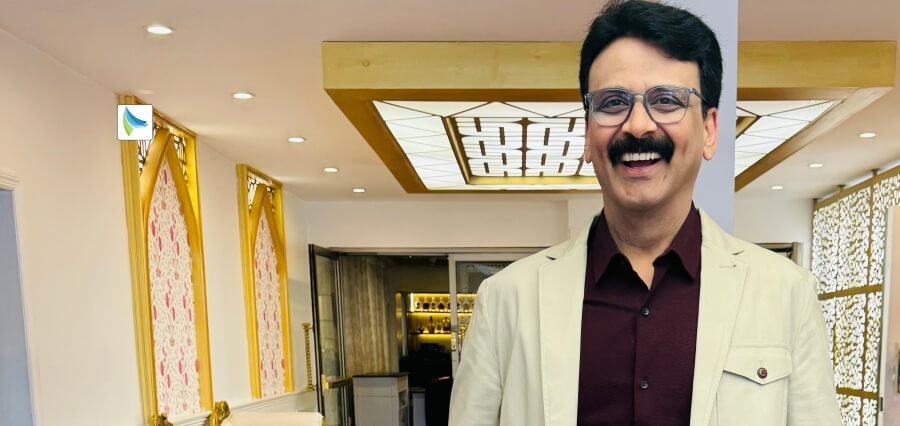

With such a visionary view of the business world, Reginald Vossen shaped his professional journey upward. Today as the CEO of BAN Flanders, he demonstrates his expertise in developing a robust business with unmatched experience.

Let us learn about his rise in depth.

The Early Career

Reginald helped establish one of the first business angel clubs in the Flemish region of Limburg in 1998. With the support of the Regional Development Company, Reginald’s innovative thinking and entrepreneurial spirit brought together a community of like-minded individuals who shared his passion for investing in promising startups and scale-ups.

Years later, in 2004, Reginald’s leadership and dedication to the cause of business angels would once again make history. Four regional business networks formed the first business angels network in Europe, the Business Angels Network Vlaanderen. And at the helm of this new organisation was Reginald himself, now serving as its General Manager.

Today, BAN Flanders boasts an impressive track record of success. Under Reginald’s leadership, the network has closed almost 500 investments in startups and scale-ups, and its membership of more than 220 business angels continues to grow.

Year after year, BAN Flanders receives hundreds of high-quality investment requests from innovative companies seeking the money and expertise they need to thrive in today’s competitive business landscape. And through it all, Reginald remains a driving force, inspiring others with his passion for entrepreneurship and unwavering commitment to the business angel community.

Reginald Vossen’s influence in the world of business angel investing continued to grow, as he took the initiative in establishing and managing three angel co-investment funds with a total committed capital of 42 million EUR. The Ark Angels Fund, Ark Angels Activator Fund, and Angelwise The Flanders Angels Fund started under Reginald’s guidance as managing partner or president.

But Reginald’s reach went beyond just these funds. In 2022, he was elected as the new Chair of the Business Angels Europe Club (BAE Club), which connects 19 of the leading angel networks in Europe and Canada. Reginald’s ambition within the BAE Club is to promote best practices in the angel market and foster cross-border collaboration and investment.

To achieve this, he defined eight focus points, including enlarging the number of joining networks, developing a level playing field on professional standards, and increasing networking and shared knowledge. He also aims to promote bilateral cooperation and ecosystems, create bottom-up initiatives on the real needs of the networks, and develop high-quality partnerships. Within a year, most of these targets were already met or initiated, showcasing Reginald’s leadership and dedication to the angel investing community.

The Unmatched Experience

BAN Flanders has become known for its flexibility, responsiveness, and resilience in the face of ever-evolving markets. In a challenging environment, the organisation has been able to adapt to new circumstances, whether adjusting to the dramatic changes brought on by COVID or responding to new economic realities due to inflation and rising production and living costs. Even when faced with essential redirections in trade flows resulting from the Russian invasion of Ukraine, BAN Flanders has shown its ability to adapt and thrive.

BAN Flanders prides itself on its agility in what is traditionally a slow-moving financial world. The organisation introduces new services, products, and procedures consecutively to foster unique needs in the market. To increase participation in mid-stage investment projects with more prominent investment tickets, BAN Flanders and Participatiemaatschappij Vlaanderen, and COI founded a 20 million euros fund in 2021 called Angelwise. Angelwise can invest up to 3 million euros in a company and aims to facilitate follow-up investments in startups that often need help with an equity gap as they enter the next development phase. With 88 participating business angels, Angelwise has become an essential tool for BAN Flanders to support these growing companies.

Innovation, transparency, and international cooperation are core values for BAN Flanders. Reginald has developed partnerships with organisations such as Doorway S.r.l. Società Benefit a fast-growing and leading Venture Capital operator based in Italy. Their unique venture investing Fintech platform allows BAN Flanders’ investors to participate in various investment opportunities, from innovative startups to IPO-listed companies and International Scale-ups.

BAN Flanders also works closely with EuroQuity, an initiative of BPI France, which provides an international (free) matching platform for innovative startups and investors. In 2021, the platform counted more than 80 Belgian startups, representing an investment portfolio of 90 million euros. With these partnerships and initiatives, BAN Flanders continues demonstrating its commitment to supporting innovation and growth in the startup community.

Reginald takes pride in the organisation’s position as one of Europe’s most prominent business angel networks. With this leadership position comes a sense of responsibility to the industry, as evidenced by BAN Flanders’ commitment to innovation, transparency, and international cooperation. In 2022, early-stage investments from business angels accounted for almost half the financial investment market, totaling 1.45 billion euros. The number of European business angel investors also saw significant growth, increasing by 22% to 39,410. While angels tend to have diverse interests, they invest in startups in three key sectors: fintech, health tech, and enterprise software.

Moving up With Technology

Businesses must stay on top of market trends and anticipate emerging sectors to maximise their impact and investment success. BAN Flanders is doing precisely that by recognising the growing importance of renewable energy, circular economy, personalised medicine, bio-based chemistry, and process transformation, in addition to already established areas such as artificial intelligence, cybersecurity, and gaming.

By developing sector-specific expertise, BAN Flanders can provide more value to startups in these sectors and make more informed investment decisions. The knowledge and experience of their business angels in these areas are invaluable assets that can help startups succeed and grow.

Sustaining the Next Chapter

BAN Flanders recognises the importance of impact investing and sustainability. There is indeed a growing global awareness of the need for companies to prioritise environmental and social impact, and this is reflected in the increasing popularity of impact investing.

BAN Flanders is developing its sustainability charter and evaluation criteria for new impact investment opportunities. This shows a commitment to talking about the importance of sustainability and taking concrete actions to ensure that their investments align with their values.

Partnering with organisations like OVO to support social entrepreneurship in Africa is also a great initiative. It’s important to remember that impact investing can positively impact communities beyond just the investors themselves, and supporting entrepreneurs in developing countries can be a powerful way to promote sustainable development.

What does the Future Hold?

BAN Flanders and BAE have ambitious goals to be leading organisations in the European business angel market. BAN Flanders is focused on servicing early-stage entrepreneurs and angel investors in Belgium and the surrounding regions. At the same time, BAE aims to foster the angel market and strengthen the angel voice on a European level, potentially through cross-border investments. These goals suggest a commitment to advancing the angel investing industry and supporting innovative startups throughout Europe.

Words of Wisdom

Reginald advises aspiring entrepreneurs to seek accompaniment, guidance, and support. There is a lot of offering out there in the market to benefit from!

“The rules for startups looking for external capital have completely changed. Every company should have a stable financial backbone to start with in terms of equity capital. Too many starters are trying too soon to obtain loans from banks, resulting in a debt structure, not such an interesting position for a young company, and most certainly not with growing interest rates. Business angels bring in a capital “for free”; this should be used to build up a healthy equity basis to be leveraged upon and to drive the growth envisaged,” Reginald concludes.