Expansion into New Horizons and Thriving in the Digital Asset Market!

The cryptocurrency market is well-known for its significant volatility, which has consistently served as both its primary attraction and its most daunting obstacle. As digital assets progressively transform the financial industry, traders are increasingly in search of platforms that can not only withstand these turbulent conditions but also leverage the opportunities presented by market fluctuations.

Recognizing this need, Deribit is a company that’s transforming the realm of digital asset trading by acknowledging the very unpredictability that deters so many others. By offering advanced trading options and risk management tools, Deribit empowers traders to navigate the highs and lows of the market effectively, turning volatility into a strategic advantage rather than a hindrance.

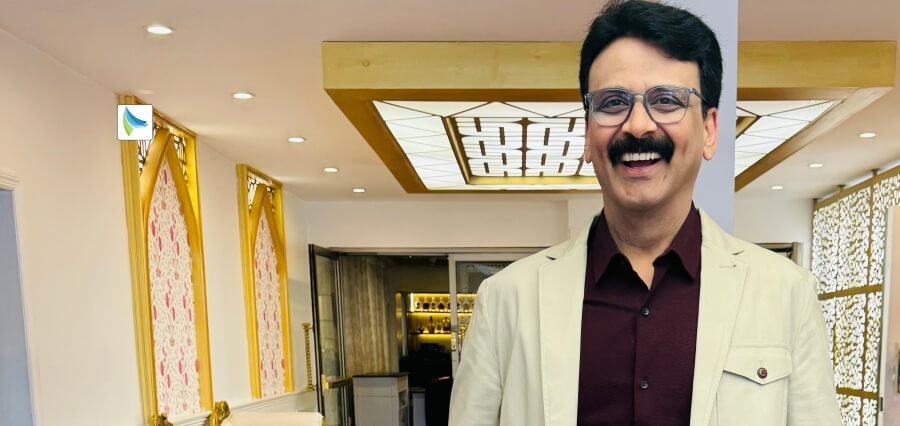

At the helm of this innovative enterprise stands Luuk Strijers, a seasoned professional with nearly two decades of experience in the financial sector. As Deribit’s CEO, Strijers brings a unique blend of traditional finance acumen and crypto-native insight to the table. His leadership comes at a crucial time as the company embarks on a bold new chapter, relocating its operations to Dubai—a move that promises to unlock a wealth of opportunities in the ever-evolving digital asset space.

Deribit’s success is built on a foundation of technological prowess and a deep understanding of client needs. The platform has established itself as a leader in the crypto options market, a testament to the trust it has cultivated among its user base. As the company prepares to launch operations in Dubai, it aims to cater to both institutional and retail investors, maintaining its commitment to accessibility without compromising on sophistication.

What sets Deribit apart is its innovative approach to risk management. In a market where fortunes can change in the blink of an eye, the company has implemented cutting-edge control measures that provide a safety net for traders. This, coupled with its ability to offer deep liquidity, has created a trading environment that’s both robust and reliable—a rare find in the often turbulent waters of cryptocurrency derivatives.

Let us explore its journey:

A Leader in Crypto Derivatives

Luuk serves as the Chief Executive Officer of Deribit, the world’s largest centralized institutional-grade crypto derivatives exchange, specializing in options and futures. With over 20 years of experience in capital markets, he has developed expertise in Listed Products, ETFs, Warrants, Equities, Derivatives, Exchange Matching, and Corporate Finance.

Under his leadership, Deribit has achieved remarkable growth, becoming the leading crypto options exchange globally and responsible for over 80% of all options trade volume. He initially joined the organization as the Chief Commercial Officer before advancing to his current role as CEO.

His strategic vision has also led to the company’s relocation to Dubai, where it established its headquarters, further solidifying its position in the market. His commitment to innovation and excellence continues to drive organizational success in the evolving landscape of cryptocurrency trading.

Deribit: Enhancing Crypto Derivatives Exchange

Deribit, founded in 2016, set out to create the world’s first cryptocurrency options exchange. Despite the challenges, the dedicated team successfully developed the platform in just over two years, officially launching it in June 2016.

Initially focused solely on Bitcoin trading, it has since expanded its offerings to include Ethereum contracts and other altcoins. The exchange now provides a comprehensive suite of products, including spot trading, perpetual swaps, dated futures, and options contracts.

Its rapid growth has propelled it to the forefront of crypto futures and perpetual contract trading. Notably, the exchange remains the industry leader in European-style cash-settled crypto options, commanding an impressive 85% market share.

Its institutional-grade platform is characterized by its extensive offerings, advanced trading features, and cutting-edge infrastructure. Traders can access linear options, perpetuals, futures, and cross-collateral trading, along with tools like delta and vega-based market maker protection, multicast data, and sophisticated margining solutions.

Inclusive and Efficient Trading Environment

Deribit is committed to creating an efficient and fair marketplace that caters to traders of all backgrounds and trading styles. The platform offers a diverse range of derivatives, including options and futures on major cryptocurrencies like Bitcoin and Ethereum. This variety enables traders to implement various strategies, manage risks, and capitalize on market opportunities.

To support traders at all levels, it provides educational resources and customer support. Notably, the platform features a free 10-hour options course available on its Insights page, designed to enhance traders’ understanding and skills.

Security is a top priority for Deribit, which employs cold storage for the majority of funds, two-factor authentication (2FA), and regular security audits to safeguard traders’ assets. Additionally, the exchange utilizes market surveillance tools to detect and prevent market manipulation, ensuring a fair trading environment. Compliance with regulatory standards further reinforces the integrity of the marketplace.

It also offers an extensive range of external custody solutions, including partnerships with Copper Clearloop, Cobo, FalconX, Fireblocks and the latest announcement Zodia, enhancing the security and flexibility of asset management.

Leading the Market with Advanced Trading Infrastructure

Deribit stands out in the cryptocurrency derivatives market due to its high matching engine capacity, low latency, advanced risk management, and exceptional liquidity. The platform’s matching engine is designed to scale effectively with increased trading volume, ensuring that it can handle significant surges in activity without compromising performance.

This capability is particularly crucial for options exchanges, where every market movement, such as fluctuations in Bitcoin (BTC), generates thousands of order updates from various market makers across numerous options series. Its ultra-fast trade matching engine boasts the lowest latencies with plans to even further reduce these, facilitating rapid transactions and enhancing the trading experience.

In addition to its robust infrastructure, it employs advanced risk management strategies and real-time monitoring to protect traders and their assets. The exchange also maintains high liquidity, making it an attractive option for both retail and institutional traders.

Setting Deribit Apart in Crypto Derivatives

The firm distinguishes itself as a transparent, secure, and regulatory-compliant cryptocurrency derivatives exchange. It was the first exchange to receive regulatory approval from VARA for both spot and derivatives trading, showcasing its commitment to compliance. Additionally, it has achieved ISO 27001 and SOC 2 certifications, providing third-party verification of its robust security measures designed to protect traders.

To enhance transparency, it publishes a daily all coin Proof of Reserves report, detailing the assets held on the platform, categorized by client assets and full disclosure of liabilities. This initiative fosters trust among users.

Furthermore, it integrates with a wide range of third-party custodians, offering traders flexibility in their asset storage options. For those who prefer not to store assets directly on the platform, this feature provides a secure alternative.

To ensure system integrity, Deribit conducts annual penetration tests for both the overall platform & endpoints and the mobile app and operates a third-party-managed security operations center, reinforcing its commitment to safeguarding user assets and maintaining a secure trading environment.

Powering the Future of Crypto Derivatives

Deribit’s cutting-edge infrastructure and advanced technology have propelled it to the forefront of the cryptocurrency derivatives market. The exchange’s high-performance trading engine is renowned for its speed and reliability, capable of processing a vast number of transactions per second with minimal latency. This lightning-fast performance is crucial for derivatives trading, where milliseconds can make a significant difference in trading outcomes.

Its scalable infrastructure is designed to handle substantial increases in trading volume without compromising performance, ensuring smooth operations even during periods of high market activity. The platform’s comprehensive and user-friendly API enables seamless integration for traders and institutional clients, supporting a wide range of functions, from order placement to market data retrieval. This API empowers efficient and automated trading strategies, further enhancing its appeal to sophisticated traders.

Moreover, it caters to a diverse clientele by allowing the reporting of block trades executed via third-party platforms or traditional over-the-phone methods. This flexibility demonstrates its commitment to providing a versatile and inclusive trading environment for all participants in the crypto derivatives space.

Catering to Diverse Traders and Trading Styles

Deribit effectively serves a wide range of traders, primarily focusing on institutional clients while also welcoming retail traders to its platform. The exchange has evolved its design over the years to accommodate various trading styles, ensuring a robust experience that rivals traditional finance.

With a comprehensive suite of institutional-grade crypto derivatives, it enables traders to manage their risk profiles and market exposure effectively. This flexibility is essential for users with varying levels of familiarity and comfort with crypto derivatives trading, from conservative to aggressive strategies. The platform’s deep liquidity further enhances the trading experience, allowing traders to execute large orders with minimal slippage.

It also supports sophisticated trading tools and features, including a user-friendly API for seamless integration of trading algorithms.

Fairness and Efficiency for All Traders

Deribit prioritizes fairness and efficiency in its marketplace through strict rules, monitoring, and platform design. The exchange operates price-time priority order books with clear trading bandwidths, ensuring a level playing field for traders with diverse backgrounds and strategies.

To further prevent market manipulation and client losses, it employs external solutions like Eventus to detect suspicious activities and has circuit breakers in place to allow the market to cool down during periods of high volatility.

Enhancing Institutional-Grade Offerings for the Crypto Market

Deribit is dedicated to further enhancing its institutional-grade offerings and attracting more participants to the cryptocurrency derivatives market. The exchange actively engages with traders to refine existing features and develop new ones tailored to their needs, all while adhering to the highest standards. Plans include expanding altcoin derivatives to include additional high-market-cap tokens and launching innovative products to provide varied exposure to crypto markets.

To draw new users into crypto trading, it is continuously improving the user interface of its mobile app and online platform, ensuring a streamlined experience that appeals to both seasoned traders and newcomers.

Additionally, the exchange is committed to publishing a diverse array of educational content, including podcasts and blog posts, to demystify the complexities of derivatives trading and equip users with essential knowledge.

Furthermore, Deribit aims to broaden its regulatory coverage, starting with a European MiFID license that encompasses both spot and derivatives trading.

Key Factors Behind Success in Cryptocurrency Derivatives

Deribit’s success in the cryptocurrency derivatives market can be attributed to several key factors. The exchange offers competitive and transparent fee structures, making it appealing to high-frequency traders and institutional clients, as lower fees can enhance profitability for active traders.

Additionally, it provides real-time market data, detailed order book information, and advanced analytics tools, empowering traders to make informed decisions and optimize their strategies effectively.

The platform’s commitment to education is evident through its webinars, tutorials, and comprehensive documentation, which help users understand its features and improve their trading skills.

Risk Management and Liquidity in Crypto Derivatives

Deribit’s unique approach to risk management and liquidity provision sets it apart in the cryptocurrency derivatives market. The exchange employs a dynamic margin system that adjusts the required margin based on the volatility and risk profile of the underlying asset, mitigating the impact of significant market movements on traders’ positions.

Its automated liquidation mechanisms handle margin breaches efficiently. If a trader’s position falls below the maintenance margin requirement, the system will automatically start liquidating the position to prevent further losses, maintain market integrity, and protect both the platform and its users.

Notably, it only liquidates the necessary portion of the client’s position to cover margin requirements, unlike other platforms that liquidate the full position.