Buying equipment or technology has become easier due to the increasing prevalence of vendor leasing. Leasing makes it easier for business owners to buy equipment or invest in new technology by spreading the costs of their equipment purchases over time. A small-town company with a big ambition to be the best independent equipment finance company in North America, Amur Equipment Finance is well on its way to support this growth model.

Amur Equipment Finance started in 1996 in Grand Island, Nebraska. AmurEF is dedicated to ensuring that its customers are equipped with the right financing structure to grow and succeed as they purchase new business essential assets. Following a significant capital investment in 2013, and a strengthening of its leadership team, it became one of the largest US equipment finance companies. Today, AmurEF is a national ranked independent commercial equipment finance provider that employs more than 120 employees across the U.S. AmurEF focuses on heartland industries ranging from transportation to manufacturing, construction, and agriculture. It also continues to develop expert knowledge about emerging technology sectors to support their acquisition as they become mainstays of tomorrow’s economy.

Amur’s uniqueness and ambitions are symbolized by its unusual symbol and mascot: the Amur leopard. One of the world’s rarest species, the Amur leopard lives on the other side of the world, along the Amur River in snow-covered Siberia. Its defining characteristics of curiosity, agility and tenacity, the Amur leopard captures the company’s curiosity to learn about its customers’ specific needs, its agility to grow and change as markets and industries evolve, and most importantly, its tenacity to do what it takes to provide a valuable service to its customers.

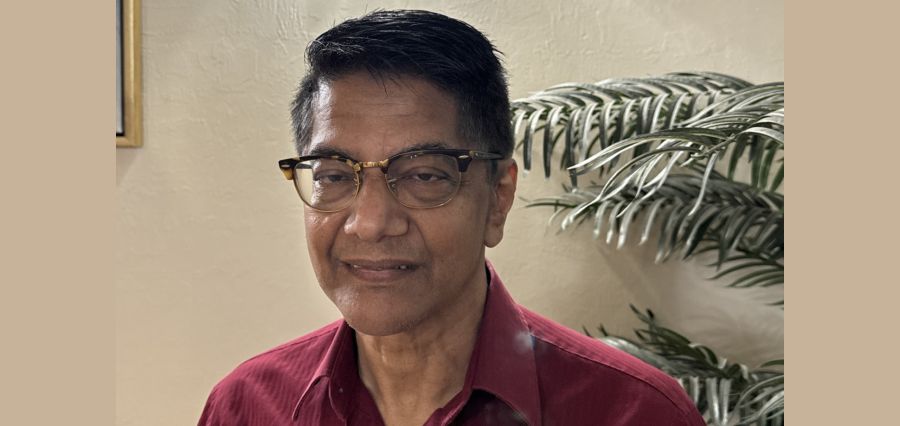

AmurEF’s philosophy is that a service orientated culture may end with the customer, but must begin with the company’s internal values “Our vision is to become the industry’s employer of choice. To be the best, means we must hire and retain the best people, and to do this we must provide every member of our team with a career that gives them a sense of pride and allows them to grow,” Mostafiz ShahMohammed, CEO, explained. “People are the engine of every great business and our people are core to making us great,” he added.

Customized Finance Programs

AmurEF directly serves business owners and vendor partners in equipment-intensive industries including transportation, construction, commercial and industrial equipment, technology, food service, agriculture, packaging, and energy. The company offers customized finance programs, including some with prompt credit decisions and same-day funding for its business customers and vendor partners. It draws upon years of asset financing knowledge, diverse industry coverage and situation-specific underwriting expertise to provide fast, friendly and flexible financing solutions. With a dedicated support team on staff, AmurEF is active in both small-ticket and middle market lending, underwriting exposures between $10k to $2MM across a wide range of credit profiles and with financing terms of up to 84 months.

An Ardent Salesperson

One of the integral members of the AmurEF team in both a management and leadership role is its Senior Vice President of Sales, Casey Mitchell. He oversees its western division, located in Mission Viejo, California. Casey has been with AmurEF for over five years and acts as the face of company to trade organizations, customers, and vendor partners to help solidify and build relationships. He has deep expertise in market penetration, client and vendor program development, risk analysis, structuring and program development. His efforts contribute to the overall health of the company.

Building Relationships

In an increasingly automated environment, AmurEF holds true to its small-town, people-focused roots. Maintaining relationships remain the back-bone of its business and how it differentiates itself from the “fintech” upstarts of the world. The company continues to adopt value-added technology and efficiencies to improve performance and customer service. It remains personally in touch with each and every customer to ensure that their needs are clearly understood and the highest quality service is delivered.

Bringing out Optimum

Efforts In 2017, Amur Equipment Finance was named a Top Ten rated national independent equipment finance company. The company is also certified as a great workplace by the independent analysts at Great Place to Work®, which evaluates workplace cultures across the globe. Additionally, several AmurEF executives have been recognized with Stevie® Awards for exemplary accomplishments and contributions in their professional fields. The company employs the second highest number of CLFP (Certified Lease and Finance Professionals) designees nationwide in the equipment finance and leasing industry, with 19 employees currently certified. And of course, AmurEF has symbolically adopted an Amur Leopard in Siberia by donating to endangered animal funds.

The company believes that its employees, their happiness and sense of purpose, all contribute in a meaningful way to bringing out its best efforts, and how they are treated is reflected in its relationships with customers, vendors and partners. Its core values, including Commitment, Integrity, Continuous Improvement, Teamwork, Results Driven, and Fun are the essence of its identity. AmurEF employees are encouraged to come forward with ideas for community and charity events to participate in. The company encourages paid time off to do volunteer work as it builds teamwork and brings out the best of every team member. AmurEF is committed to supporting community organizations and efforts. The company is of firm belief that every employee plays a significant role in helping to build and define the company’s culture and values.

Leveraging Flexibility

According to AmurEF, vendor partners face a variety of challenges, from rising input costs, to tight labor markets for key personnel, new competitors enticed by an expanding economy, and the risk of technological obsolescence. To navigate these challenges, vendors need a finance partner who is able to provide timely and consistent underwriting outcomes, and an “end-to-end” service that leaves every customer satisfied. AmurEF also provides technical integration to its vendors, such as marketing support, quote tools, and application portals, in a way that is a visible or transparent, as active or as passive as any vendor requires. Most importantly however AmurEF maintains a full service to every vendor regardless of size that is built around good old-fashioned human resources.

Disciplined Approach

In the opinion of AmurEF, vendor leasing has enjoyed quite a run in recent years, attracting bank and captive sources, as well as independents, all taking advantage of historically low rates. As rates move up and credit windows tighten, the inevitable cycle of industry turnover will commence. According to the company, banks may jettison their equipment finance arms and brokerages, and independents could lose access to capital, captives might become risk averse. All but the best of credits will see difficulties in getting adequate service.

Since the mid-90s, AmurEF has a track record of maintaining its relevance across all markets and through multiple economic cycles. Its disciplined approach to underwriting and deployment of capital ensures that its vendor partners will be able to draw on its strength when their customers will need it the most.

Showcasing Excellence

“A vital point of success is a leasing partner that we are able to work with. By working with Amur we’ve found that. We’re very happy to be a close partner.” – Kevin Abergel, VP of Sales and Marketing, MGI USA.

“Amur has been instrumental in allowing Diebold Nixdorf to work with a number of franchisee organizations in fulfilling their POS solutions.” – Francis Carrillo, Project Manager, Retail Division, Diebold Nixdorf.

“They work hard to listen and work through a customer’s “story” on the tougher credits. The team is always exceptional, I am very happy with all my Amur Equipment Finance contacts.” – Drew Fisher, F&I Manager, Utility Trailer Sales Southeast Texas, Inc.

Source: The 10 Most Active Vendor Leasing companies 2019