The world we live in is a dwelling full of uncertainties and risks. Individuals, families, businesses, properties, and assets are exposed to different types and levels of risk. These include the risk of losses to life, health, assets, property, etc. Although it is not always possible to avert unwanted events from occurring, the financial world has brought about products and services that protect individuals and businesses against such losses by compensating them with financial resources. Insurance is such a financial product that reduces or eliminates the cost of loss or effect of loss caused by different types of risks.

But insurance is not the most desirable product. iPhone is a desirable product. People stand in queues to avail the latest iPhone; but you would not find the masses showing the same enthusiasm for buying insurance. The reason is simple: because insurance makes people ponder on an uncomfortable question that they would rather not think about – “what if something went wrong?”

It is the art of a skilled financial advisor or insurance agent to sit down with their client and make them question their future and how they would mitigate any risk if it were to arise. An independent insurance agent, however, is a broker who is not employed by any specific insurance agency. Rather, they act as a middleman to connect insurance buyers and sellers in order to facilitate a transaction.

But traversing the insurance sector is a tricky endeavor filled with its own variety of uncertainty. In the pursuit to bolster their clients’ financial futures and safeguard business operations, independent agents have to rely on their wits and their tenacity to help their clients find the best risk mitigation product.

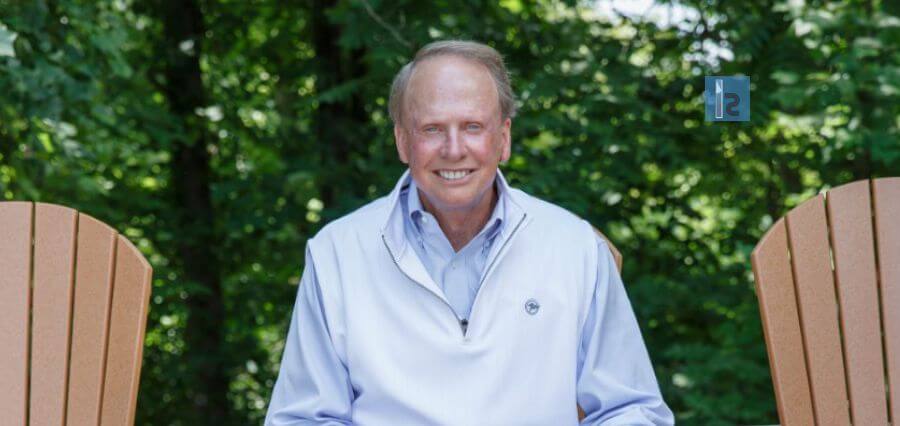

Fortunately, there is a man who has made it his life’s mission to foster a community of growth and prosperity for such independent agents. Since 1978, this man has been establishing his prominence and gradually building a legacy for himself in the insurance sector. Meet Mike Griffin – the CEO of First Choice Agents Alliance, LLC (FCAA), the President of Griffin Insurance Agency Inc. and a Majority Member of Tarheel Insurance Services, LLC.

Under the supervision of Mike Griffin, these agencies have grown to the pinnacle of being continuously ranked among the top agencies in the country, earning numerous industry honors and recognition. He was inducted into the Nationwide Insurance Sales Hall of Fame in 2011.

Recently, Mike has been highly involved in growing his newest enterprise, First Choice Agents Alliance, into a big player in the insurance aggregator industry and is committed to developing a quality organization for insurance agents across the United States.

FCAA is an insurance agency network created to assist independent agents in securing top-level company contracts and developing meaningful business plans to help them grow their existing revenue stream. FCAA guides agents to manage carrier relationships, increase their knowledge, and set the stage for continued growth and profitability.

The Birth of a Career

While still in school, Mike worked for his father in the HVAC business and, at the same time, began working part-time in the jewelry business after school and on holidays. It was here that he developed a keen interest in the jewelry business and pursued it after college, taking on the responsibility of managing a store for a small local chain.

He was introduced to the insurance business by a District Manager for Nationwide Insurance who had moved into his neighborhood. Little did he know at the time that this neighborly relationship would lead to a major career transition.

Watching his father grow his HVAC company from the ground up, Mike picked up some useful skills and learned some valuable lessons about establishing a business. To begin, you’ll need a strategy and the willingness to take some risks along the route to attain your objectives. Mike has used this crucial lesson many times during his insurance career.

The Griffin Insurance Agency and Tarheel Insurance Services

For over 40 years, Griffin Insurance Agency has provided superior insurance solutions to its consumers. It has established itself as a trusted advisor for its policyholders in all aspects of personal and commercial risk management needs, with nine offices and over 50 staff members in the Piedmont region of North Carolina. The agency takes great pride in having highly qualified, licensed professionals handling its clients’ needs. As a result, the business is continuously ranked among the Nationwide Insurance Companies’ top 25 agents.

Because of the agency’s performance and the increased need for competitive pricing in the business market, there was a growing need for other sources of ‘workers compensation’ (WC) coverage. After brainstorming with Nationwide Insurance leadership, Mike suggested a concept to develop a WC wholesaler to deal with Nationwide Captive Agencies exclusively in order to give them a greater opportunity to serve their clients.

Tarheel Insurances Services, LLC was founded by Mike and his son, Rob Griffin, in November 2005. Tarheel began operations by dealing with agents primarily in North Carolina, but soon, its success allowed it to expand its operational territory to 27 states, with over 1100 agency ties. Rob has managed the WC business from the beginning, and together with his dad’s relationships, this company continues to experience positive growth.

Tarheel is dedicated to offering affordable rates and industry knowledge to its agents, allowing them to match their insureds with the carrier that best suits their needs. Tarheel gives clients access to a professional staff familiar with every aspect of the WC space, focusing on lowering ‘Workers Compensation’ expenditures. This has distinguished them as a go-to provider in the business world as a specialty broker.

Until recently, Griffin Insurance, the retail firm, was a captive agency affiliated with the Nationwide Insurance Companies. When Nationwide decided to restructure its business strategy in 2015, allowing its agents to represent other commercial carriers for the first time, a need arose to discover more markets to service their expanding business client base. This was easier said than done, and many agents discovered they either couldn’t handle more carriers or couldn’t get the needed appointments.

The Inception of First Choice Agent Alliance

Based on Tarheel’s success, Mike was approached by several of his peers and asked about forming a wholesale brokerage outlet where Nationwide agents could go for all lines of commercial coverage. Mike, Ron Parks and four of his highly recognized industry peers gathered in Washington, DC, in March 2015 to discuss the proposal. And thus, First Choice Insurance Brokers was born after a lot of planning and development from Mike and Ron!

The concept of First Choice Insurance Brokers was sound. However, throughout the implementation of this business strategy, Mike and his colleagues ran into some unexpected difficulties. Agents (all Nationwide exclusives at the time) were just not ready or equipped to move business away from Nationwide, nor did they have the necessary understanding of other carriers to effectively represent them in the market. Despite the fact that the brokerage unit swiftly grew to over 270 agents, Mike understood he needed to make a change.

There was a need for greater agent education in the carrier space and there was a need for other carriers to trust that these agents knew what they were doing. There was also a need for the agents to recognize that they could succeed outside of Nationwide. The idea of assisting agents in gaining additional representation would be inadequate without this.

A New Direction

Mike had a chance meeting with Diane Wagner after battling with this company idea for almost 18 months. Diane was a marketing representative for one of First Choice’s carriers. They began talking about the company’s uphill battle and the timescale and additional funding that would be required for prospective profitability.

During this initial meeting, Diane inquired if First Choice had ever considered becoming an aggregator instead of a wholesale brokerage market. Aggregators assist agents in setting up direct appointments and then pool the producer volume to create larger revenue opportunities.

As the conversation progressed, Mike learned that Diane (in a previous life) had been instrumental in establishing an aggregator from the ground up and had served as its President for several years. At that point, Mike asked Diane about joining the team and assisting in the transition from the present business model to that of an aggregator. A few months later, Diane was appointed as the COO of First Choice Insurance Brokers.

The changeover was planned in the fourth quarter of 2016, and all 270+ contracts with the brokerage unit were canceled on January 1, 2017. As a result, the ‘new’ model only began with the original 20 investors. Because exclusive agents were unfamiliar with the role of an aggregator and how they would manage direct writings from other carriers, the company’s initial growth was slow. Despite this, FCAA was able to enroll an additional 70 agents in its first year.

FCAA Today

Today, First Choice has over 380 members and is fast establishing itself as one of the fastest-growing premium volume networks in the United States. FCAA continually supports its members by providing contract assistance, technology guidance, training materials, and an experienced management team dedicated to assisting agents in maximizing their revenue. Each agency receives additional sales help as needed and annual strategic planning to establish and implement plans to achieve targeted goals.

Top carrier alignment and exceptional compensation plans are available to its members. FCAA is certain that the tools they offer to member agencies is a roadmap for achieving profitable expansion by applying industry best practices.

What First Choice brings to the table

The following are some of the advantages of becoming a member of First Choice:

- Access to top insurance company contracts

- Significantly higher excess compensation earning potential

- Higher base commissions

- A multitude of vendor resources

- Strategic planning at the ‘agency owner’ level

- Producer sourcing

- Producer development programs

- Best practices, procedures, and analysis

- Succession planning

- Internal security reviews

- Google presence optimization

- Target marketing plans

- Bi-weekly educational webinars

- Member portal with carrier and vendor resources

- Monthly newsletter

- Annual Meetings and Trade Shows

Networks can usually provide direct carrier codes with lower volume requirements than an agency might receive on its own. These less stringent rules enable an agency to represent several companies that it might not otherwise be able to. The best element of partnering with First Choice is the opportunity for additional revenue above and beyond what an agency could earn on its own. There are no minimum premium requirements, so agencies may start earning growth incentives and contingencies with their first dollar of premium production.

The Winning Spirit

Mike Griffin developed a desire for winning as a result of his upbringing in a sports-rich environment. It’s a passion that he’s carried with him throughout his life, in both personal and professional undertakings. His leadership approach is filled with this passion, and it has shaped his career.

Mike started working with Nationwide Insurance in 1978 as an agent, but his major duties now, as CEO, are to listen to his management team, offer counsel and assistance, and support them in their tasks. Mike is extremely proud of the management personnel at each of his companies. He knows that each of these teams is composed of a great group of highly dedicated professionals who do an awesome job directing the success of their respective areas of responsibility.

His professional accomplishments have not come at the expense of his personal life. Mike and his wife Cindy live in Cornelius, North Carolina, where they live a happy and fruitful life. Meredyth, Robert, and Courtney are their three grown children. Mike enjoys being with his family, as well as being on the lake, on the golf course, and traveling with his wife.

To a Prosperous Future

As an experienced entrepreneur, Mike Griffin advises his employees to always keep a 1/3/5-year plan in front of them. Their goal is to maintain a steady rate of growth! “Our approach is for agents who believe what we believe and want to see their agencies flourish,” Mike confidently declares. “We believe we can assist them in achieving these objectives,” he added.

Mike is equally concerned about his team’s personal development. ‘Reinvent yourself regularly, not just when you realize you’re losing ground,’ says one of their objectives. In fact, this is how he views leadership: assisting people in excelling in their chosen fields with passion. He accomplishes this by instilling in them the belief that they can overcome hardship. This he considers a success.

Mike’s vision for FCAA’s future is to continue to grow responsibly and become the preferred aggregator for insurance agents across the country, all of this while maintaining the organization’s quality and integrity.