Columbus, Ohio, is a thriving center of commerce, education, and culture, embodying the forward-thinking spirit of the Midwest. As one of the fastest-growing cities in the region, it boasts a diverse economy fueled by industries ranging from technology and healthcare to finance and real estate. This vibrant economic environment makes Columbus an attractive destination for investors seeking opportunities to grow their wealth. However, alongside legitimate investment ventures, the city is not immune to the darker side of finance: investment fraud. In a landscape filled with financial advisors and investment firms, the potential for unethical practices can pose serious risks to residents.

Scams involving false promises, unauthorized transactions, and hidden fees can devastate an individual’s financial security. Victims of such fraud often face a complex battle to recover their losses and hold responsible parties accountable. Navigating these challenges requires expertise and a thorough understanding of the legal and financial systems. Consulting with an experienced investment fraud lawyer can be instrumental in building a strong case and pursuing justice. By addressing these issues head-on, Columbus investors can protect themselves and contribute to a more transparent and accountable financial ecosystem.

Detecting Investment Scams

Spotting fraudulent behavior marks the first phase in the process of safeguarding investments and financial security planning. Unethical conduct by consultants could involve activities like trading without permission from investors’ accounts and distorting information about investment prospects to inflate profits while burdened with excess fees. Investors must stay alert and routinely scrutinize their account statements to verify that all transactions correspond with their established investment plan and objectives.

Collecting Proof

To build an argument effectively and convincingly, presenting evidence is crucially important. Collecting records such as account statements and communications with advisors is a key step in the process. It’s essential to maintain documentation of all interactions and transactions to support the arguments. Additionally, seeking testimonies from witnesses, like family members or colleagues who were involved in the discussions, can greatly enhance the credibility of the case.

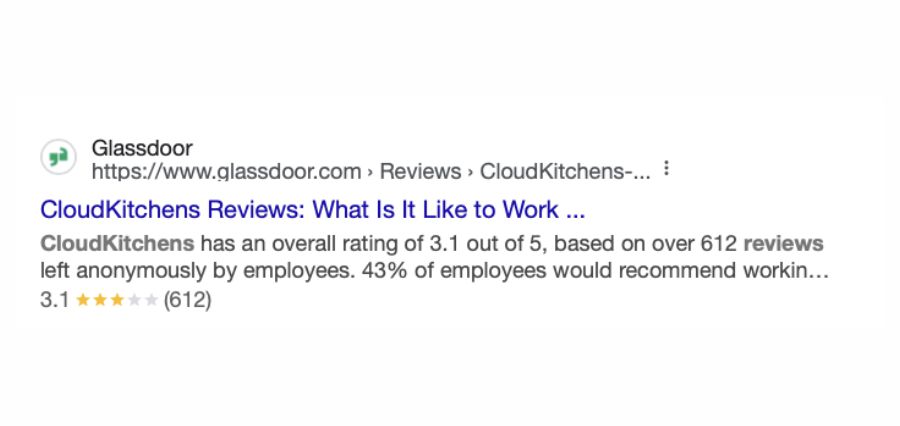

Seeking Advice from Professionals

Consult with a lawyer who specializes in investment fraud to improve your chances of a claim significantly. They have the expertise to navigate systems and provide advice on effective strategies. When meeting with them, share all evidence and explain what happened clearly to build a strong case.

Submitting The Claim

Collecting evidence and obtaining support in preparation for filing a claim is the most important action to take. Seek redress through arbitration or mediation or resort to court proceedings as deemed appropriate based on the situation and existing contractual arrangements. Each option entails protocols and conditions that need to be comprehended. Legal advisors will be instrumental in deciding on the best course of action moving forward.

Exploring Results

Different results can occur when taking action against advisors; winning cases could lead to regaining lost investments or receiving compensation for losses and even penalties for the advisor’s actions. However, not all cases will necessarily end favorably. It’s crucial to understand the risks involved and to have your expectations clear throughout the process.

Exploring Options for Resolving Disputes

Methods like mediation or arbitration provide options to settle disputes without going to court, which can be faster and more affordable than going through the legal process. Mediators and arbitrators assist in guiding discussions between the involved parties to reach agreements that are satisfactory for all parties involved. As such, many individuals opt for these methods to steer clear of public court trials, which could potentially result in better outcomes for investors in terms of settlements.

Putting an Emphasis on Prevention

The most effective way to protect yourself from investment fraud is through prevention tactics like conducting research before choosing advisors and verifying their credentials and backgrounds to avoid potential problems in the future. It’s also important to diversify your investments and keep communication lines open with your advisors to reduce risks. Regularly examining statements will help ensure that your investments are in line with your goals and strategies.

Keeping Up with the Latest News

Investors need to stay updated on their rights, and on how things work in the industry they’re in. Being aware of any rules and updates on investment scams can give them the necessary information to protect themselves. Taking part in financial education programs or attending workshops can help them learn more and feel confident when making decisions.

Looking for Communities for Support

Dealing with investment fraud can feel quite lonely at times. It’s helpful to reach out to friends or experts in finance and law for viewpoints and emotional backing. Connect with those who have gone through similar challenges; they can provide both reassurance and useful tips. Establish a circle of people to help you navigate the process of making claims.

In Summary

Filing claims against advisors for investment fraud requires attention, and making well-informed choices is crucial in this process. Identifying fraud, collecting evidence, seeking advice from professionals, and grasping the procedures for submission are crucial stages in pursuing fairness. Although obstacles might crop up, staying knowledgeable and seeking assistance can help people feel more capable of managing this journey. Taking appropriate steps enables investors to protect their well-being and ensure that deceitful advisors are held responsible for their behavior.