With the aim of achieving $100 billion market capital and becoming the third crypto currency, Ethereum has positioned itself with a market of $98.1 billion.

Ethereum has yet to reach $1,000 on most western exchanges; South Korean traders have bid the price of ether up to $1,322, allowing its global average to extend into four-digit territory. At present, a plurality of ETH trading is concentrated on Binance, which accounts for more than 20 percent of daily ETH volume.

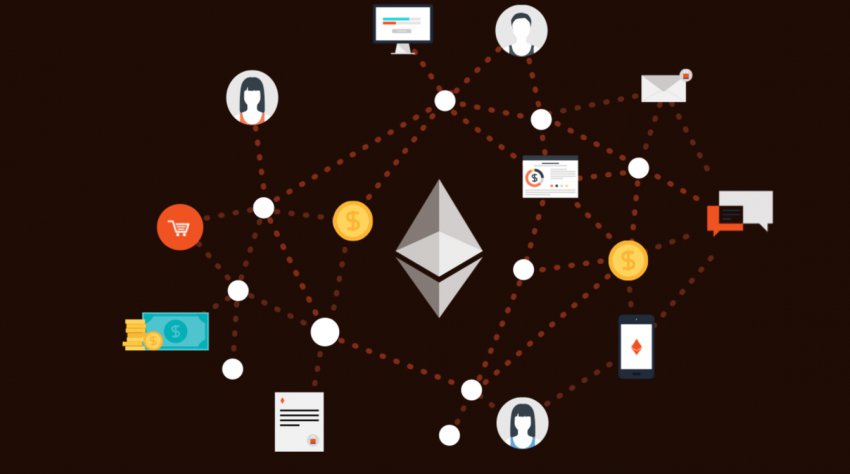

Ethereum is the next Facebook owing to the enormous amount of use cases that one finds in major industries which are benefiting greatly from its decentralization & transparency. Ethereum is basically the application which is processing nearly double the number of transactions of bitcoin at a million a day. Aaron Batalion, partner at Lightspeed Venture Partners said he expects to see more 50% price jumps in ether, with big returns down the road.

“Over the next five to ten years, I believe it will be worth 10 or 100 times its current value,” Batalion said.

Initial Coin Offering is the largest real world use case for Ethereum. Any startup can issue its own currency, usually called tokens or coins, using blockchain technology. These tokens may be bought, sold, or exchanged for another crypto currency, such as Bitcoin or Ether currencies. In recent weeks, though, investors have been selling off the digital currency. It sank to as low as $175.56 earlier this week, according to Global Digital Asset Exchange (GDAX), before rebounding. In a recent trading, it was at $208.87. ICOs are democratizing funding and laying the next wave of innovation from young hungry businesspersons all over the world who will eventually contribute back to their local communities for a improved future.

Ethereum is allowing the developers to build and run the applications without having to worry about the underlying operating system just like “Apple”. The technology underpinning Ethereum has a real world practice that has yet to be ajared and money to be channeled into innovative Ethereum projects via ICOs at an unbelievable rate. The currency is the “fuel for the ethereum virtual machine,” said Andreas Weiler, head of markets at Smith and Crown, a crypto-financial research group.

An Ethereum blockchain platform, Adbank has announced an ICO after raising $3 million in a private presale and intends to prevent digital advertising fraud to promoters and digital publishers. Recently, an estimated $223.74 billion will be spent worldwide on digital advertising, with middlemen taking up to 75% of the investment, and advertisers losing another $16.4 billion to ad fraud. The Adbank API to shape the value of their products while expanding the Adbank ecosystem and to assimilate services into existing products can be used by the third parties.