It was the goal to lower the lending industry entry barrier and allow anyone to compete on a level playing field with large FIs that led Dmitry Voronenko to form TurnKey Lender, a company that is transforming how lending is done around the world. Dmitry founded TurnKey Lender along with his partner Elena Ionenko and currently the company serves clients in over 50 countries with 6 offices around the globe. Currently, Dmitry serves as CEO of the company leading a talented team worldwide. The idea from the start was ambitious. The goal was to disrupt the lending automation space status quo with a lightweight yet robust end-to-end lending automation platform which would be flexible and scalable enough to digitize crediting for any organization type, from banks to alternative lenders and from manufacturers to medical professionals.

Since then, TurnKey Lender has become one the leading providers of lending automation and embedded financing software globally, offering the only SaaS platform that automates not only all digital lending operations but also credit decisions at every stage of the loan life cycle in real-time.

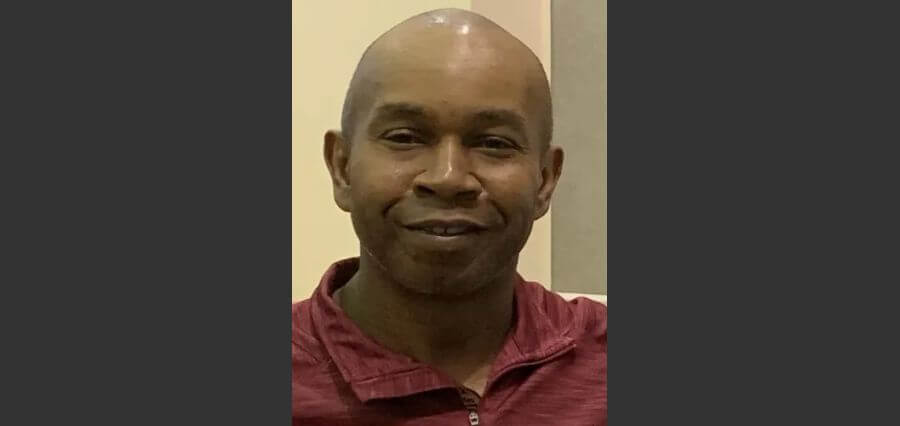

In an interview with Insights Success, Dmitry sheds light on his journey and his contribution to the lending industry through TurnKey Lender.

Below are the highlights of the interview:

What is your opinion on the necessity for businesses to align their offerings with newer technological developments, especially when it comes to Managing BFSI Industry?

Customers today have little to no patience or trust for businesses who haven’t embraced digitalization in a meaningful way. If your business doesn’t prioritize technology, your competitors will. And as a result, their offering will be cheaper, easier to get, and more customer friendly. Technology has become the life raft for streamlining the lending processes, eliminating wasted time, and optimizing outdated business flows. And most importantly, for staying top of mind for customers in the ever-increasingly digital economy.

It’s clear that the BFSI sector doesn’t need more of the same solutions to move the industry forward. At TurnKey Lender our focus is on automation of credit and judging on the increased demand, 2020 taught businesses worldwide a valuable lesson about postponing digital transformation or applying stopgap measures where real change is due.

What people, what books, what life factors have influenced and impacted you?

Growing up in a multinational region and leading my companies through three major world crises are among the factors that influenced me most as an entrepreneur. Along the way, I’ve been fortunate to meet some inspiring, wise, and brilliant people. But I’d say that the life paths, business strategy, and approach of Jeff Bezos and Marc Benioff have taught me a lot.

And regarding the books, these three have stood out to me, and I’m sure they will resonate with your readers too:

Selfish Gene by Richard Dawkins

Good to Great by Jim Collins

The Hard Thing About Hard Things by Ben Horowitz

What is your thought on the necessity of a positive work culture? In what ways do you implement it at your organization?

The TurnKey Lender team is distributed across six offices around the globe. It’s a living organism that we as its leaders need to keep healthy, happy, and motivated to drive forward the growth of our organization.

You spend a huge part of your life interacting with your colleagues. And if at the end of the workday employees are burned out and feel drained of their internal resources, it’s going to have a devastating effect on the morale and productivity in the long run. That is why we foster a positive work culture and only hire people that we trust and enjoy working with.

In what ways have you contributed to the community? If given a chance, what change would you bring in to making BFSI Management Simple?

At TurnKey Lender we’re proud that over 20% of all our clients are non-profits and companies that extend credit to immigrants, asylum seekers, and underdeveloped communities to bolster the quality of life and speed of business development. Over the last 20+ years, I’ve focused on creating cloud-based, AI-driven financial solutions to reach small, mid-size, and enterprise-grade lenders and provide them with easy-to-use, accessible and affordable automation solutions.

The BFSI sector has been our focus since the foundation of TurnKey Lender, and today, it’s evident more than ever that the industry is long overdue for a meaningful change. And our technology is up for the challenge to bring about that transformation.

How do you envision on sustaining your company’s competency in a cutthroat and volatile world of business? Where do you see your company in the next five years?

After spending most of my career working on cutting-edge technology, it never ceases to amaze me how quickly things can change. And the only way to sustain the positions we’ve gained as a company and improve upon them is to tirelessly innovate. In addition, our clients provide us with invaluable insight on where different domains of the lending industry are moving. By staying in tight contact with lenders worldwide we get first-hand understanding of what features, modules, and scoring models are needed most and then dedicated teams in our R&D centers bring them to life in new product releases or within the professional services we provide our customers.

What are your future aspirations? What strategies is it undertaking to achieve those goals?

Right now, we operate on three continents with clients in 50+ countries and growing. In the last year we’ve carried out a significant expansion in North America and Asia. Moving forward, the name of the game for us continues to be reaching ever wider customer groups and suiting their needs better than anyone else with intelligent automation. Machine learning and deep neural networks, a field I have a Ph.D. in, are the backbone of TurnKey Lender and this has been one of the key factors differentiating us from the competition. At the same time, the platform’s end-to-end modular functionality and flexibility allow TurnKey Lender to adjust the platform to any lending business’ needs. I’d say we’re well on track with our goal to democratize lending worldwide and become the go-to choice for lenders in search of end-to-end lending processes automation, decision management, and risk mitigation solutions and services.

As an established business leader, what would be your advice to the budding entrepreneurs aspiring to venture into Information Services Industry?

The same principles dictate success in the information services industry as in other domains. So, to anyone who needs this advice right now, here goes:

You must find your true inner nature. Because as long as you try to fit into someone else’s role, you won’t be fulfilled. Never give up. You never know how many tries it may take, but once you found your true self, you have to keep moving forward.

Love your competitors. Same as in sport, you must respect your rivals and the work they do to learn from them. But even more importantly, you can’t afford being poisoned by hate.