In today’s world, where everything from your groceries to your dinner reservations can be done online, it is only apparent that financial services ride this wave of digital transformation.

The finance industry is changing rapidly with the introduction of new technologies, and legacy institutions are struggling to keep up. Financial Institutions (FIs) across the world are all required to comply with KYC regulations for customer identification and verification purposes. However, there are limitations on how much information can be collected from customers and what kind of data can be collected to not violate privacy rights.

Moreover, where there is data, there is the threat of cyber-attacks, and FIs are the most lucrative targets for ransomware, phishing, and other data security threats. This is where companies like Asignio play a significant role in protecting FIs against such vulnerabilities.

Based in Seattle, Washington, Asignio provides a quick, innovative, and reliable sign-in technique – synchronous dual biometrics, which combines passive facial recognition and handwriting.

In the following interview, Kyle Rutherford, the CEO, shares his insights on the company’s journey in the FinTech industry and his vision for future innovations under Asignio’s label.

Following are the interview highlights

Please brief our audience about Asignio, its USPs, and its position as a leading player in the financial services space?

Asignio was founded to make sign-ins easier and more secure. In the market, we saw that passwords were becoming a more cumbersome and a less secure solution, complex biometrics have limitations (i.e., selfies are vulnerable to deep fakes, and, if there is a data breach, your thumbprint, eyeball, etc. data is compromised, and there is no way to change them.), and fraud is rising dramatically.

Our unique technology, synchronous dual biometrics, combines passive facial verification and handwriting recognition to provide fast and extremely secure authentication. The system is built as a platform that enables cross-device and cross-account authentication, meaning users only need to create their signature once and then can use it anywhere. Asignio is working with multiple large Financial Institutions (FI’s) to provide their customers and employees a better sign-in experience.

What other services/solutions does Asignio offer, and how are these impacting the industry and its clients?

Asignio has partnered with DocuSign, a leader in e-signature, to provide a solution called TCA (Transaction Confirmation and Approval), which combines the compliance capabilities of DocuSign with powerful authentication capabilities of Asignio. This solution is targeted at stopping money movement fraud, especially wire transfer fraud.

Wire transfer fraud is a massive issue (over $42B lost) and has grown exponentially in the last year. The solution has garnered interest across the financial services industry, and we are currently testing with DocuSign to ensure that the system runs smoothly before a wider launch later this year.

We’re also offering an SMS Biometric replacement for SMS OTPs (text verification one-time passcodes). SMS OTPs have become ubiquitous as a second layer of security, but they are also particularly vulnerable to phishing, Sim swap, and SS#7 attacks.

Asignio’s SMS biometric uses the same system customers are already familiar with, they simply receive a link instead of a code. They can sign-in more securely using with their Asignio’s sign-in instead of simply transposing a passcode.

If customers are not already signed up with Asignio, the system can default to an SMS OTP. But for customers needing a higher level of security, FI’s can have them on-board with Asignio, and then use our SMS Biometric for an easy, more secure way to access their accounts and transact.

Being an experienced leader, share your opinion on the impact of the adoption of modern technologies such as AI, big data, and machine learning on the finance niche, and what more could be expected in the future?

AI, big data, and machine learning have all had a major impact on the financial services industry, but, unfortunately, with our focus on security, we’ve also seen some of the negative impacts of AI and machine learning.

Fraudsters are using machine learning and AI to constantly attack FIs. FIs are trying to combat this fraud with passive authentication solutions leveraging machine learning and AI, such as behavioral biometrics (i.e., movement tracking like your walking gate or typing style, VPN or WiFi use, locations, etc.) There are a few problems with these:

1) Consumers often feel they are invasive and annoying if they don’t work (i.e., if your transaction depends on your gate, so do you have to walk around the block a couple of times to get it to work?),

2) A large percentage of fraud is ‘friendly,’ done by someone you know.

Metrics tied to your device could potentially not prevent these, i.e., if your phone knows it’s you because it tracks where you typically login, then if your family member picks up your phone, they could be granted access.

3) With machine learning, fraudsters are often able to replicate these results and break into the systems

With Asignio, the user must be actively signing in themselves. The handwriting symbol is extremely difficult for someone else to copy, but combined with the live selfie (our Synchronous Dual Biometrics), it is almost impossible spoof. While AI, big data, and machine learning can all have positive impacts in the finance niche, companies also need to be cognizant of the risks of using these technologies and be careful they don’t open the door to more fraud.

Considering the current pandemic, what initial challenges did you face, and how did you drive Asignio to sustain operations while ensuring the safety of its employees at the same time?

We had the typical challenges of an overnight shift to remote work and delays as our customers scrambled to find solutions to new problems. We immediately shut down the office and moved to remote work. Our team worked a hybrid schedule before, so it was only a matter of a couple of weeks before we were back to full capabilities.

Modern technology made the move to remote much easier, and we will continue to remain a mostly remote workforce moving forward. Our biggest challenge was a slowed sales cycle. We had more difficulties reaching clients as they adjusted to working remotely.

What would be your advice to budding entrepreneurs who aspire to venture into the financial services space?

Build a good team and be willing to be flexible. Timelines will elongate, your product will need to change, and the space is constantly shifting. If you have a great team and remain flexible in your thinking, you can find a lot of success in the financial services space.

Also, try to get traction outside of financial services while you pursue this industry. The FI industry is so regulated there are extra hurdles to getting adoption that can extend timelines.

How do you envision scaling your company’s operations and offerings in 2021?

We’re in trials now with a couple of financial institutions. Once we roll those services out, we will need to scale rapidly.

We’re also working on NIST approval which should open up another partnership that, once we get through testing, will again require rapid scaling in new industries. We are constantly continuing to build out our company and grow the team to better service our customers.

About the Leader

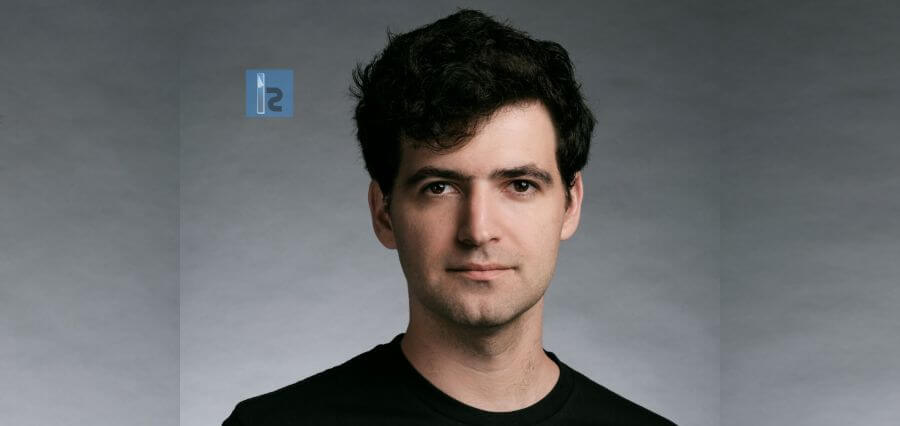

Kyle Rutherford, Founder, and CEO is a serial entrepreneur who has over 30 years of experience in a variety of industries, all technology-focused, but his current passion is improving the authentication experience and secure access to your data so you can transact safely.

This is especially relevant in financial services where an account takeover can cost FIs large sums of money and, even more importantly, their customer’s trust. Kyle has a degree in software and an MBA from Harvard. He is an expert on product technology and has helped the team develop something that is incredibly secure without sacrificing user experience. He has also built a great team around him to deliver on his vision.